Imagine cruising down a scenic path, the wind in your hair, feeling the thrill of the ride. Your bicycle is more than just a mode of transport; it’s a cherished companion.

But have you ever considered what would happen if your bicycle were damaged or stolen? That’s where bicycle insurance comes in. You might be wondering, “How much does bicycle insurance cost? ” Well, you’re in the right place to find out.

This article will explain bicycle insurance costs, helping you make an informed decision. By the end, you’ll feel confident knowing how to protect your beloved bike without breaking the bank. Keep reading to discover how to safeguard your rides and enjoy peace of mind.

Table of Contents

Factors Influencing Bicycle Insurance Cost

Bicycle insurance costs vary based on several factors. Understanding these factors helps you choose the right plan. Let’s explore the key elements affecting your bicycle insurance costs.

Type Of Bicycle

The type of bicycle impacts insurance costs significantly. High-end bicycles often have higher premiums, and custom or specialty bikes can also increase costs. Regular commuter bikes might be cheaper to insure.

Coverage Level

The level of coverage affects the insurance price. Basic coverage usually costs less, while comprehensive plans with more benefits cost more. Choose a plan that matches your needs and budget.

Rider’s Location

Your location plays a role in insurance pricing. Urban areas may have higher rates due to theft risks, while rural regions offer cheaper premiums. Insurers consider local crime rates and accident statistics.

Rider’s Age And Experience

Age and experience can influence costs. Younger riders may face higher premiums, while experienced riders might get discounts. Insurers often consider riding history and claims records.

Usage Frequency

How often you ride affects insurance costs. Frequent riders may pay more, while occasional riders might find cheaper options. Insurers assess the risk based on usage patterns.

Credit: www.isinwheel.com

Types Of Bicycle Insurance Coverage

Bicycle insurance offers various coverage options, including theft, damage, and liability protection. Costs vary based on bike value, coverage level, and location. Understanding these variables helps determine the right plan for your needs.

If you’re a cyclist, you know how important it is to protect your investment. Bicycle insurance can offer peace of mind, but understanding the different types of coverage available can be tricky. Knowing what’s out there helps you make informed decisions about your needs. Let’s break down the types of bicycle insurance coverage you might consider.

Theft And Damage

Theft is a common concern for cyclists. Imagine locking your bike outside a cafe, only to find it missing when you return. Theft coverage can ease this anxiety by covering the cost of a stolen bike. Damage coverage, however, can help with repairs or replacements if your bike is involved in an accident.

Liability Coverage

What if you accidentally crash into a pedestrian or another cyclist? Liability coverage can protect you from the financial fallout of such incidents. It covers the costs if you’re responsible for injuries or damages. Ensuring you have this can save you from unexpected expenses.

Personal Accident Protection

Consider what happens if you’re injured while riding. Personal accident protection covers medical costs and can compensate you for lost income. It’s a reassuring option if you rely on cycling as a primary mode of transportation or for sports.

Accessory Coverage

Bikes often come with expensive accessories like GPS devices, custom saddles, or specialized wheels. Accessory coverage ensures these items are protected against theft or damage. This could be invaluable if you’ve invested heavily in your bike’s setup. Have you ever considered which coverage best aligns with your cycling habits? Each type offers specific benefits, which can help tailor insurance to your needs. What’s your top priority when protecting your bike and yourself?

Average Cost Of Bicycle Insurance

Bicycle insurance is increasingly popular among cyclists. It offers peace of mind. But how much does it cost? The average cost depends on region, bicycle type, and coverage level. Let’s explore these factors in detail.

Comparison By Region

Insurance costs vary by region. Urban areas tend to have higher rates due to increased theft risk. Rural areas usually have lower costs, as fewer theft incidents occur there. Regional living expenses also influence rates. Premiums are often higher where living costs are high.

Comparison By Bicycle Type

Bicycle type affects insurance costs. High-end bikes have higher premiums because they are expensive to replace, while basic models usually have lower rates. Premiums are calculated based on the bike’s value. Electric bikes may have higher insurance costs because their components are more costly.

Comparison By Coverage Level

Coverage level greatly impacts costs. Basic coverage is the least expensive. It covers theft and minor damages. Comprehensive coverage costs more. It includes accidents and liability protection. Riders choose coverage based on their needs. More coverage means higher premiums.

Credit: simplebikeinsurance.com

Ways To Reduce Bicycle Insurance Cost

Reducing bicycle insurance costs is a smart financial move. Lowering premiums requires knowing specific strategies. Here are effective ways to cut down expenses and keep your bike covered.

Bundling Policies

Combine bicycle insurance with other policies. Insurers often offer discounts for bundling, including home, auto, or other types of insurance. It’s a simple way to save money, and managing one policy is easier.

Increasing Deductibles

Opt for a higher deductible to lower premiums. A deductible is the amount paid before insurance kicks in. By choosing a higher deductible, monthly costs decrease. Ensure the deductible is affordable in case of a claim.

Installing Security Measures

Enhance your bike’s security to reduce insurance costs. Install locks, alarms, or GPS trackers. Insurers may offer discounts for improved security. A secure bike lowers risk and premiums.

Maintaining A Safe Riding Record

Keep a clean riding record to benefit from lower premiums. Avoid accidents and traffic violations. Insurers reward safe riders with discounts. It’s a win-win for safety and savings.

Choosing The Right Bicycle Insurance

Bicycle insurance costs vary based on coverage options and bike value. Basic plans start at $100 annually and offer theft and accident protection. Comprehensive coverage may increase the premium. Always compare different policies to find the best fit for your needs and budget.

Choosing the right bicycle insurance can feel like navigating a maze. With so many options available, it’s crucial to pinpoint the best fit for your needs. The right coverage can mean the difference between peace of mind and unexpected expenses.

Assessing Coverage Needs

Start by identifying what you need. Do you primarily ride in the city, or are you more of a mountain trail enthusiast? Urban cyclists might worry more about theft, while off-road bikers could be concerned with accident coverage. Consider the value of your bicycle and how often you ride. A high-end bike used daily might need comprehensive coverage. On the other hand, an occasional rider with a budget bike might opt for a basic plan.

Evaluating Insurer Reputation

Not all insurers are created equal. Look for customer reviews and testimonials. Have friends or fellow cyclists had good experiences? A good reputation often means reliable customer service and fair claim handling. Remember, the cheapest option isn’t always the best. Your insurer’s reputation can save you headaches down the line.

Reading Policy Terms Carefully

Skimming through the policy terms is tempting, but resist the urge. Details matter here. What exactly does the policy cover, and what are the exclusions? Look for hidden fees or conditions that might affect your coverage. Being informed about the terms can prevent surprises when filing a claim.

Seeking Expert Advice

Don’t hesitate to seek advice from experts if you’re unsure. A local bike shop or cycling community might offer insights. Have they dealt with insurance claims before? What were their experiences? Consider consulting an insurance broker. They can provide personalized advice and help you find a policy tailored to your needs. Choosing the right bicycle insurance isn’t just about cost. It’s about finding the right coverage, reputation, and service balance. What’s your strategy for picking the perfect policy?

Credit: www.bikeinsure.com

Common Misconceptions About Bicycle Insurance

Many people misunderstand bicycle insurance and believe myths about coverage. This leads to confusion and missed opportunities for protection. Let’s debunk some common misconceptions.

Bicycles Covered By Home Insurance

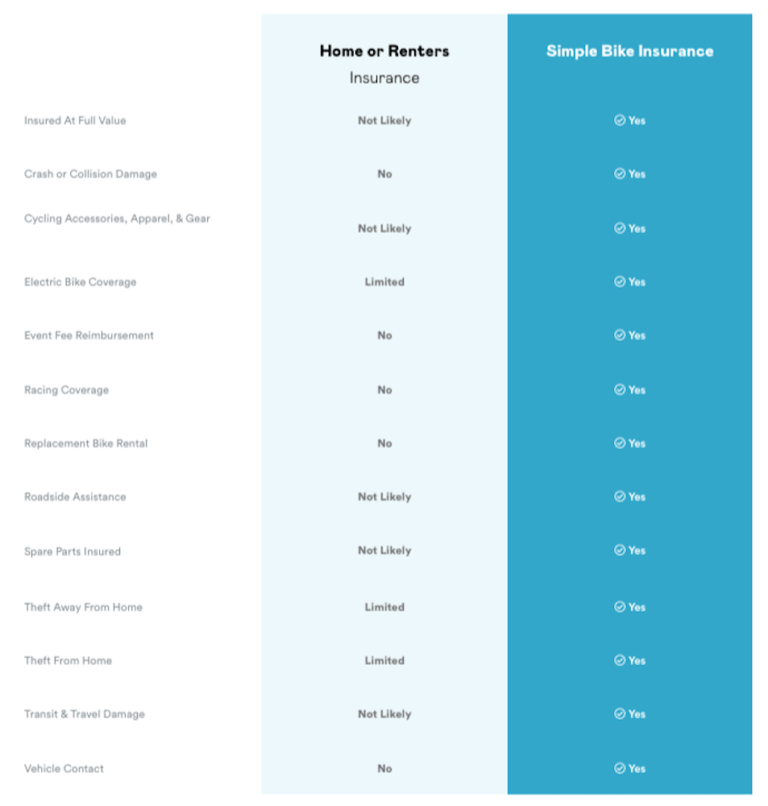

Some people think home insurance covers bikes. This is not always true. Home insurance might offer limited coverage and often excludes theft away from home. You need bicycle insurance for better protection. Check your policy details carefully.

Only Expensive Bikes Need Insurance

Another myth is that only costly bikes need insurance. All bicycles risk theft or damage, and even cheaper bikes can be expensive to repair or replace. Insurance provides peace of mind, regardless of your bike’s price.

Insurance Is Too Expensive

Many assume bike insurance costs a lot. In reality, prices vary based on factors like location and coverage level. Some plans are quite affordable. Compare different options to find a plan that fits your budget.

Frequently Asked Questions

What Factors Influence Bicycle Insurance Cost?

Bicycle insurance costs depend on several factors, including the bike’s value, your location, and coverage level. Additional factors include your riding habits, security measures, and previous claims. Each insurer may also have specific criteria affecting premiums. Comparing different providers can help you find the most cost-effective option.

Is Bicycle Insurance Worth The Cost?

Bicycle insurance provides financial protection against theft, damage, and liability claims. It is worth the cost if you own an expensive bike or frequently ride in high-risk areas. This insurance can save money in unexpected incidents, offering peace of mind and security.

Does Bicycle Insurance Cover Theft And Damage?

Yes, most bicycle insurance policies cover theft and damage. Coverage typically includes accidental damage, vandalism, and theft. However, reading the policy details is essential to understand specific inclusions and exclusions. Some policies may require secure bike storage or locks to validate theft claims.

How Can I Reduce My Bicycle Insurance Premium?

Consider increasing your deductible or bundling policies to reduce your bicycle insurance premium. Installing security devices like GPS trackers or robust locks can also lower costs. Maintaining a claim-free history and comparing quotes from multiple insurers may help you find discounts and better rates.

Conclusion

Bicycle insurance costs vary based on several factors. Your location affects the price. So does the type of coverage you choose. Comprehensive plans cost more. Basic plans are cheaper. Your bike’s value also influences the cost. Higher value means higher premiums.

Shopping around helps you find the best deal. Compare different providers, check customer reviews, and consider what coverage you need. This ensures you pay only for necessary protection. Ensuring your bicycle can save money in the long run. It’s a smart choice for peace of mind.